Facts About San Diego Home Insurance Uncovered

Facts About San Diego Home Insurance Uncovered

Blog Article

Get the Right Protection for Your Home With Tailored Home Insurance Policy Insurance Coverage

Tailored home insurance coverage offers a safety and security web that can give peace of mind and financial security in times of situation. Browsing the intricacies of insurance policy plans can be challenging, specifically when trying to identify the specific coverage your one-of-a-kind home requires.

Value of Tailored Home Insurance Coverage

Crafting a personalized home insurance plan is important to make sure that your protection properly shows your specific demands and conditions. A customized home insurance coverage surpasses a one-size-fits-all method, using you details protection for your one-of-a-kind circumstance. By functioning very closely with your insurance policy company to customize your policy, you can ensure that you are appropriately covered in the occasion of a claim.

One of the crucial advantages of tailored home insurance is that it permits you to consist of coverage for products that are of specific worth to you. Whether you have pricey fashion jewelry, rare artwork, or specific tools, a tailored policy can make certain that these possessions are secured. Furthermore, by tailoring your protection, you can readjust your deductibles and restrictions to line up with your risk tolerance and financial abilities.

In addition, a customized home insurance coverage takes right into account factors such as the place of your building, its age, and any unique functions it might have. This tailored approach assists to alleviate prospective voids in coverage that might leave you exposed to risks. Inevitably, spending the moment to tailor your home insurance plan can provide you with peace of mind understanding that you have extensive security that satisfies your details needs.

Assessing Your Home Insurance Demands

When considering your home insurance needs, it is vital to examine your specific scenarios and the specific threats connected with your residential or commercial property. Examine the age and problem of your home, as older homes may require more upkeep and can be at a greater danger for concerns like pipes leaks or electrical fires.

By extensively reviewing these variables, you can establish the level of protection you need to properly protect your home and properties. Remember, home insurance policy is not one-size-fits-all, so tailor your policy to meet your certain requirements.

Customizing Protection for Your Home

To customize your home insurance coverage efficiently, it is necessary to customize the protection for your specific building and specific demands. When personalizing coverage for your home, think about aspects such as the age and building and construction of your home, the value of your personal look at here now belongings, and any distinct functions that may require unique insurance coverage. If you possess costly precious jewelry or artwork, you might require to add additional protection to shield these items properly.

Moreover, the location of your property plays an important duty in customizing your coverage (San Diego Home Insurance). Houses in locations vulnerable to all-natural disasters like quakes or floodings might call for added insurance coverage not consisted of in a standard policy. Understanding the dangers related to your area can help you customize your coverage to alleviate possible damages effectively

Additionally, consider your lifestyle and individual preferences when customizing your protection. If you regularly travel and leave your home vacant, you may want to add protection for theft or vandalism. By tailoring your home insurance policy to fit your particular requirements, you can ensure that you have the best defense in position for your home.

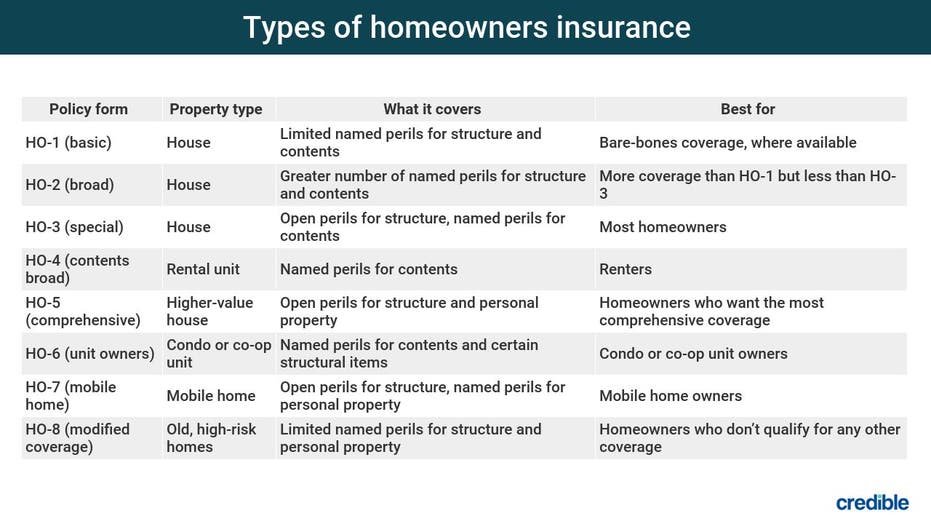

Understanding Policy Options and Purviews

Checking out the various policy alternatives and limitations is critical for getting an extensive understanding of your home insurance policy protection. Plan options can include insurance coverage for the framework of your home, individual valuables, obligation defense, added living expenditures, and more. By very closely examining policy alternatives and limits, learn this here now you can customize your home insurance policy coverage to give the protection you need.

Tips for Picking the Right Insurance Provider

Comprehending the importance of choosing the appropriate insurance provider is extremely important when ensuring your home insurance protection aligns completely with your demands and provides the needed defense for your assets. When selecting an insurance company for your home insurance policy, take into consideration aspects such as the business's reputation, monetary security, customer support high quality, and protection alternatives. Research the insurance firm's background of managing insurance claims quickly and fairly, as this is vital in times of demand. Look for any testimonials or issues online to determine consumer satisfaction levels. It's also recommended to contrast quotes from numerous insurance companies to guarantee you are obtaining competitive rates for the insurance coverage you require. An additional pointer is to assess the insurance firm's determination to tailor a plan to fit your particular demands. A great insurance firm needs to be clear regarding what is covered in the plan, any kind of exemptions, and the procedure for submitting an insurance claim. right here By adhering to these ideas, you can make an educated decision and choose the ideal insurance provider for your home insurance coverage needs.

Conclusion

Crafting an individualized home insurance plan is important to ensure that your protection accurately mirrors your private needs and conditions (San Diego Home Insurance). Analyze the age and condition of your home, as older homes might need more upkeep and could be at a higher risk for concerns like pipes leaks or electrical fires

To tailor your home insurance plan successfully, it is necessary to tailor the coverage for your particular residential or commercial property and private requirements. When customizing protection for your home, take into consideration elements such as the age and building and construction of your home, the value of your items, and any special features that might call for unique coverage. By carefully taking a look at plan alternatives and limits, you can tailor your home insurance policy protection to provide the security you require.

Report this page